Uninsured & Underinsured Motorist Coverage: Recent Changes to Virginia Law & Why You Should Renew Your Insurance Coverage NOW!

By Matthew W. Broughton, Jared A. Tuck, and Summer Associate Joshua R. Justus

It can be easy to ignore the worst case scenario until it actually happens, and when it does, you don’t want to be left wondering what you could have done differently.

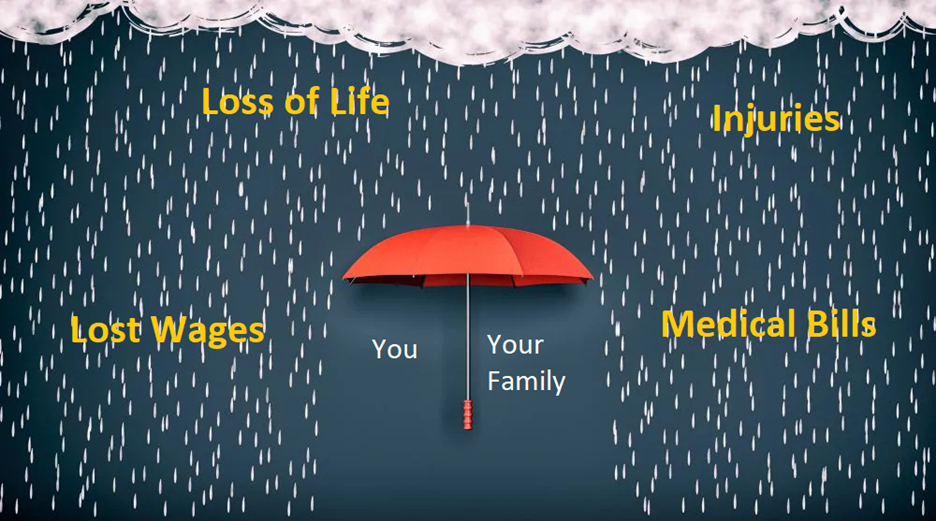

Uninsured motorist coverage (UM) and underinsured motorist coverage (UIM) act like a safety net for you and your family if you are involved in a collision with a motorist who either: doesn’t have any motor vehicle insurance or doesn’t have enough insurance to cover your damages. It is common for survivors and surviving family members of large truck crashes to suffer millions of dollars in medical costs or lost income alone. This financial burden is one that you can take steps to reduce or prevent altogether by reviewing your current uninsured and underinsured motorist coverage and obtaining an umbrella policy.

Uninsured motorist coverage (UM) and underinsured motorist coverage (UIM) act like a safety net for you and your family if you are involved in a collision with a motorist who either: doesn’t have any motor vehicle insurance or doesn’t have enough insurance to cover your damages. It is common for survivors and surviving family members of large truck crashes to suffer millions of dollars in medical costs or lost income alone. This financial burden is one that you can take steps to reduce or prevent altogether by reviewing your current uninsured and underinsured motorist coverage and obtaining an umbrella policy.

Prior to July 1, 2023, under Virginia law, your potential UIM payout after a collision with an underinsured motorist would be reduced by the underinsured motorist’s liability coverage.[i] For example—defendant negligently rear-ends Sally on June 15, 2023, causing $100,000 in damages. The defendant only had $50,000 in liability coverage. Sally had $50,000 in uninsured motorist coverage (UM) per her insurance policy. The math:

The result is that Sally does not receive any payment for her damages over the defendant’s liability coverage, although she has $100,000 in damages due to the collision. Assuming that the defendant does not have any significant assets, Sally’s recovery would be limited to $50,000 from the defendant’s liability insurer.

Now that the law has changed, your potential payout is not reduced by the underinsured motorist’s liability coverage. For example, if the current law applied in Sally’s scenario above, she would be able to recover compensation for all $100,000 of her damages. She could potentially recover $50,000 in liability coverage from the defendant’s policy and $50,000 in underinsured coverage from her own policy. In other words, you are now able to benefit from your entire underinsured policy limits when the damages from the collision exceed the liability coverage of the other motorist.[ii] However, you must renew your policy after the July 1, 2023 date for this change to take effect. Now is the best time to both renew your policy and consider increasing your coverage, so that you and your family are protected today and into the future.

Umbrella insurance policies are another great way to keep your family safe from crippling financial burdens that may result from a motor vehicle collision. If UIM coverage is your safety net, then an umbrella policy is the giant landing pad under the net if it fails. Given the expensive nature of damages from motor vehicle collisions—especially where there are multiple family members in the car—umbrella coverage is a must have.

An umbrella insurance policy with uninsured and underinsured motorist coverage will provide additional protection in the event that the damages from the collision exceed your UIM and the negligent motorist’s liability coverage. With this additional policy, you can drive knowing that you, and your family, will get the amount of coverage you need, when you need it.

Next Steps to Protect You & Your Family:

- Contact a qualified insurance agent near where you reside and discuss the available options to meet your needs. Do not use online insurance brokers!

- Renew your UIM insurance policy as early as possible to take advantage of the changes to the law.

- Consider increasing your current UM and UIM coverage.

- Consider adding an umbrella policy with UM and UIM coverage. Many umbrella policies contain only liability coverage. It is important to ask your agent to include UM and UIM coverage as part of the umbrella policy.

- Do not sign any documents asking you to elect or agree to reduce your available UIM coverage by the underinsured motorist’s liability coverage.

[i] Va. Code Ann. § 38.2-2206(B) (effective until July 1, 2023).

[ii] Va. Code Ann. § 38.2-2206(B) (effective July 1, 2023).