While our tax practice is wide-ranging by any measure, our personalized client service is built on trust.

This healthy balance is what distinguishes Gentry Locke. That, and our ability to find new and unexpected solutions to the daunting tax problems that confront businesses.

The attorneys in Gentry Locke’s Tax practice specialize in helping clients with the most important professional service for tax clients: Planning. We develop plans for every aspect of your business, because nearly every business decision has tax consequences. Experience has taught us that the single best way to avoid problems is to plan for contingencies well in advance.

Let there be no doubt—when controversy does indeed arise, Gentry Locke is more than capable of tackling the issues at hand.

Clients look to us for assistance with estate planning, the transfer of family wealth, building or rehabilitating with state and federal tax credits, allocating tax credits out to investors, executive compensation, employee benefits, and of course, tax audits.

We make the complex seem simple, which is one of the reasons we have long-standing client relationships in tax law.

We encourage you to review our Tax Practice Group attorneys’ personal pages for additional information and then contact us to discuss your legal needs.

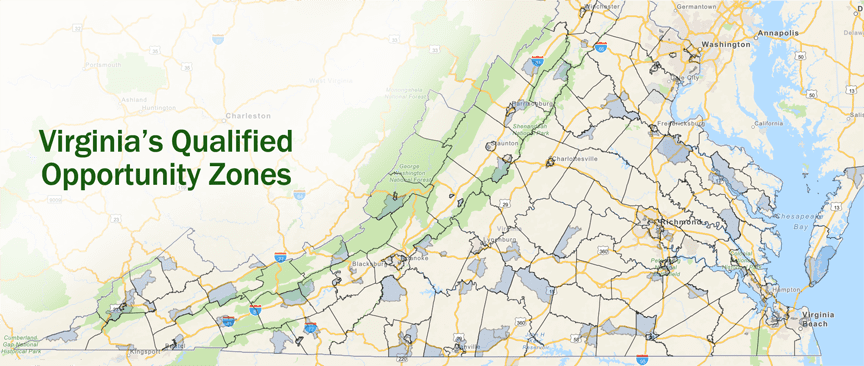

Opportunity Zone Investment

The Tax Cuts and Jobs Act passed by Congress in December of 2017 established the Opportunity Zone incentive program, designed to encourage investment in designated low-income communities. In October 2018, the Treasury Department and the Internal Revenue Service issued proposed regulations which provide guidance and framework for investments in these Qualified Opportunity Zones. Virginia currently has 212 Qualified Opportunity Zones.

Gentry Locke can assist you in evaluating the Opportunity Zone incentive programs, as well as exploring the potential of combining tax credit financing through federal and state historic rehabilitation tax credit programs, and the New Markets Tax Credit Program.

Contact a member of our Opportunity Zone investment team to discuss the incentive program and for assistance in evaluating whether participation in an Opportunity Zone investment may be a good fit for your specific project or investment portfolio.

To find out if an area of your interest is located in of one of Virginia’s hundreds of Qualified Opportunity Zones, click on the map image below and you will be taken to an interactive map.

Tax Planning – Business Entities

Gentry Locke tax lawyers take the lead in tax planning and the structuring of domestic limited partnerships, limited liability partnerships, limited liability companies, and joint ventures, as well as in traditional forms of organization, mergers and acquisitions, reorganizations, and capital expansion programs for corporate clients.

We render advice on and prepare and negotiate complex operational arrangements and agreements:

- Shareholder agreements

- Employment contracts

- Buy-sell agreements

- Business succession plans

- Estate plans

- Qualified and nonqualified deferred compensation arrangements

- Business entity selection

- Partnership and limited liability company structures

- Pass-through entities

- Formation and operation of trusts

- Private annuities

Tax Planning – Individuals & Families

Planning is key for individuals and families who wish to assert some measure of control over how much of their estate goes to people, and how much to government entities. Inaction can lead to astonishingly negative tax ramifications. Gentry Locke tax attorneys assist clients in maximizing estates to benefit those who our clients feel are most deserving.

Our experience enables us to render advice on and prepare legal instruments for:

- Qualified Conservation Easements

- Establishment of Charitable Trusts

- Gift tax minimization

- Section 1031 Exchanges

- Stock Redemptions

- Shareholder Agreements

- Family Limited Partnerships

- Trusts

- Charitable Contributions

- Capital Gains

- Individual Retirement Accounts

- Defective Grantor Trusts

- Personal Residence Gain Exclusion

- Vacation or Second Homes

- Self-Employment Taxes

- Personal Residence Trusts

- Unified Credit

- Estate Tax Exemption

Audits & Tax Controversies

Handling controversies is a strength of Gentry Locke attorneys. We have represented all types of taxpayers in federal, state, and local administrative tax disputes before the Internal Revenue Service, the Virginia Department of Taxation, and local authorities.

Clients benefit from our experience in the following areas of tax law:

- Federal individual tax audits

- Federal corporate tax audits

- Federal payroll tax audits

- Virginia income tax audits

- Virginia corporate income tax audits

- Virginia sales and use tax audits

- Federal excise tax audits

- Department of Labor audits of employee benefit plans

- Offers in compromise

- Representation in IRS collection activities for unpaid taxes

- Settlements of IRS controversies

- Release of tax liens