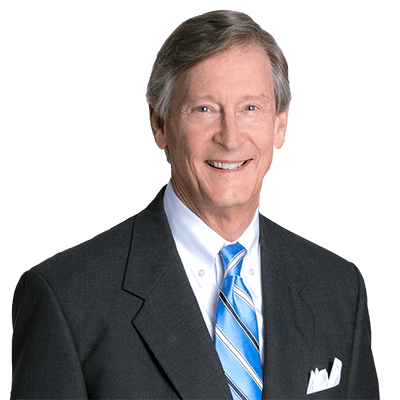

Bill Gust is a Senior Tax Partner with Gentry Locke located in the Roanoke, Virginia office. For more than 40 years, Bill has worked with business owners relative to tax, business transitions, employee benefits, corporate, and sophisticated estate planning matters. With his expertise in implementing business succession strategies, Bill has assisted in the successful transition of many privately held businesses, through sales, mergers and implementation of numerous ESOPs. A member of the American College of Trust and Estates Counsel, National Center for Employee Ownership (NCEO) and the ESOP Association, Bill is a frequent lecturer on estate, business and tax planning as well as IRS and DOL compliance matters. As a part of his corporate practice, Bill regularly advises clients on mergers & acquisitions issues, qualified and nonqualified retirement and executive deferred compensation plans. He is consistently noted as a Virginia Super Lawyer in Tax Law, based on his high degree of peer recognition and professional achievement, and is consistently noted by Best Lawyers in America list for Tax and Employee Benefits (ERISA) Law.

-

Years at Gentry Locke

-

What makes Gentry Locke different?

The firm is an interesting amalgam of people. We are hard working. We have created a culture based on relationships and respect. Personally, I take great interest in my clients.

Education

- Georgetown University Law Center, LL.M in Taxation

- George Mason University School of Law, J.D. with distinction

- Virginia Polytechnic Institute and State University, B.A.

Experience

- Represented numerous corporations in the negotiation and implementation of sales, mergers and other restructuring with transaction values in excess of $250 million

- Successfully represented numerous companies in tax controversies involving tax disputes in United States District Court, United States Tax Court, and the Court of Federal Claims, resulting in substantial taxpayer recoveries

- Represented numerous professional and other corporations in the design and implementation of qualified retirement plans and unqualified deferred compensation arrangements for key employees

- Represents numerous public and private companies in the adoption and operation of Employee Stock Ownership Plans (ESOPs) and subsequent stock purchases from public and private shareholders

- Structured and implemented numerous acquisitions of turbine and rotary aircraft for U.S. and foreign companies; regularly oversees compliance with FAR Part 91 and Part 135 air operations

- Represents many individuals and families in the structuring and implementation of sophisticated estate plans, designed to minimize the negative impact of state and federal taxes in conjunction with the sale or transition of a business

Affiliations

- Member, Roanoke-Blacksburg Regional Airport Commission (past Chairman)

- Past Chair, Board of Governors, Trusts and Estates Section, Virginia State Bar

- Fellow, American College of Trust and Estate Counsel

- Member, Tax, Trusts and Estates, Health Care, Business Law Sections, Virginia State Bar

- Member, Tax, Employee Benefits, Corporate Sections, American Bar Association

- Member, Roanoke Valley Estate Planning Council

- Member, ESOP Association; NCEO, Mid-Atlantic Chapter of ESOP Associations

Awards

- Named “Roanoke Lawyer of the Year” for Tax Law (2024)

- Named “Roanoke Lawyer of the Year” for Employee Benefits (ERISA) Law (2022)

- Named to Best Lawyers in America, Employee Benefits (ERISA) Law and Tax Law (2003-2024)

- Named a “Leaders in the Law” honoree by Virginia Lawyers Weekly (2020)

- Designated one of the “Legal Elite” by Virginia Business magazine for the area of Taxes/Estates/Trusts/Elder Law (2015-2017, 2020, 2023) and Business Law (2018)

- Named to Virginia Super Lawyers for Tax Law (2012, 2014-2019)

-

News

Nov 2023 -

News

Aug 2023 -

Articles

Mar 2023 -

Events

Dec 2021 -

News

Dec 2020 -

News

Aug 2020 -

Events

Mar 2020 -

Articles

Jan 2020 -

News

Jan 2020 -

Events

Sep 2019 -

News

Aug 2019 -

Events

Jul 2019 -

News

May 2019 -

News

Apr 2019 -

News

Dec 2018 -

News

Aug 2018 -

News

Apr 2018 -

News

Feb 2018 -

Articles

Feb 2018 -

Events

Feb 2018 -

Events

Feb 2018 -

News

Dec 2017 -

News

Aug 2017 -

News

Apr 2017 -

Events

Jan 2017 -

Events

Jan 2017 -

News

Dec 2016 -

News

Oct 2016 -

News

Apr 2016 -

Events

Mar 2016 -

Events

Mar 2016 -

News

Jan 2016 -

News

Dec 2015 -

News

Aug 2015 -

News

Apr 2015 -

Events

Apr 2015 -

Events

Mar 2015 -

News

Aug 2014 -

News

Jun 2014 -

News

Aug 2013 -

News

Jun 2013 -

News

Feb 2013 -

News

Oct 2012 -

News

Sep 2012 -

News

Jun 2012 -

News

Apr 2012 -

News

Dec 2011 -

News

Dec 2004